The Trump administration is preparing to restart one of the most aggressive debt collection tools in the federal government’s arsenal: wage garnishment.

Beginning in early January, student loan borrowers who have fallen into default could see part of their paychecks automatically diverted to repay their debt; a move that could affect millions of Americans already struggling financially.

Wage Garnishment Returns for the First Time Since Payment Pause

For the first time since the start of the payment pause, defaulted federal student loan borrowers will again face wage garnishment. Collection activity had been frozen since March 2020, offering borrowers temporary relief during an unprecedented economic crisis.

That pause is officially over. The Department of Education confirmed that garnishment actions will begin again in January, marking a major shift toward stricter enforcement.

January 7 Is the Date Borrowers Need to Watch

Starting the week of January 7, the Education Department plans to send administrative wage garnishment notices to approximately 1,000 borrowers. Officials say this is only the beginning, with the number of notices expected to grow steadily each month.

Once the notice period ends, employers will be legally required to withhold part of affected workers’ paychecks.

What It Means to Be “In Default”

Borrowers are considered in default when they are 270 days or more past due on their federal student loan payments. Default status triggers serious consequences, including loss of access to repayment plans, damaged credit, and now, renewed wage seizures.

Currently, more than 5 million borrowers are in default; a figure the Education Department has warned could climb to nearly 10 million in the near future.

How Much of Your Paycheck Can Be Taken

Federal law allows the government to garnish up to 15% of a borrower’s after-tax income. However, there is a minimum income protection in place.

Borrowers must be left with at least 30 times the federal minimum wage per week, or $217.50, according to higher education experts. For many low- and middle-income workers, even this reduced garnishment could significantly strain household budgets.

The Government’s Unmatched Collection Powers

Unlike private lenders, the federal government has extraordinary authority to collect on student loan debt. In addition to wages, it can seize:

Federal tax refunds

Social Security retirement benefits

Social Security disability payments

These tools make it extremely difficult for borrowers in default to avoid repayment once collection activity begins.

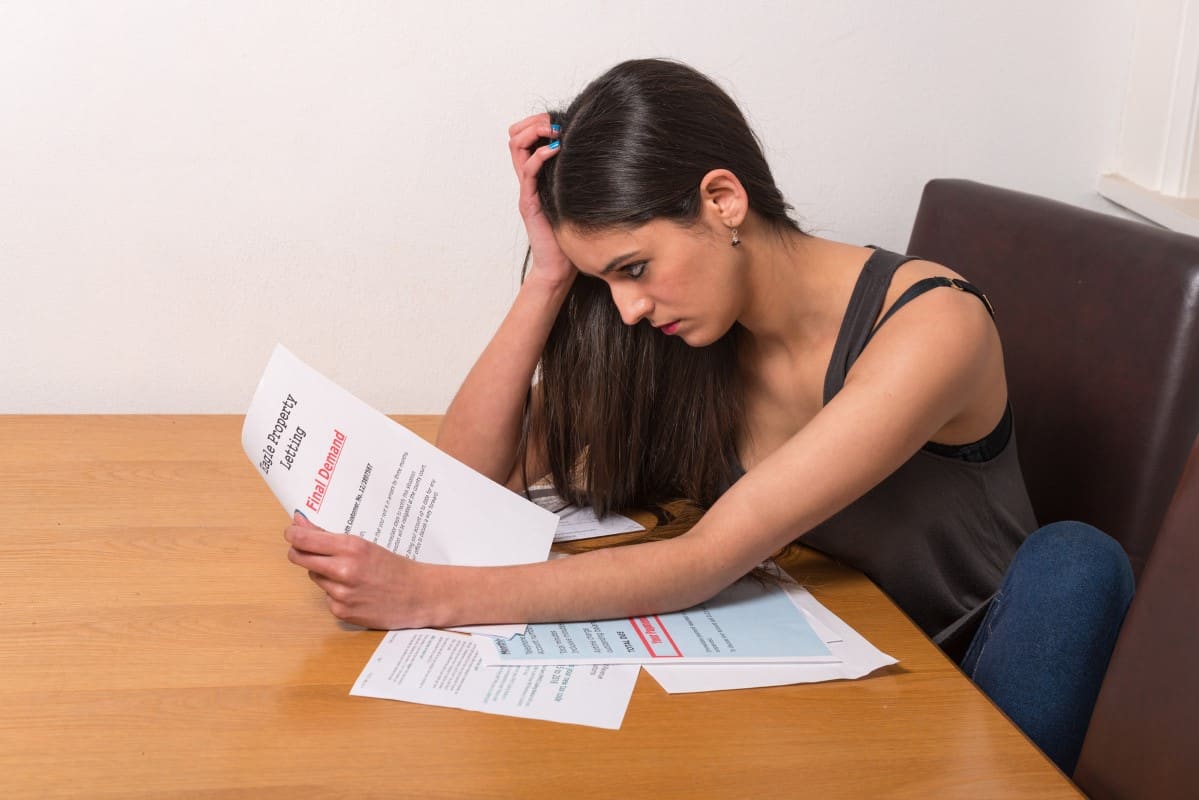

Why Borrowers Are Especially Vulnerable Right Now

Student loan holders are facing pressure from multiple directions at once. A weakening labor market, rising costs of living, and frequent changes to repayment systems have made it harder for many borrowers to stay current.

Recent issues accessing relief programs have only added to the confusion, pushing more borrowers toward default just as enforcement ramps up.

A $1.6 Trillion Problem Affecting 42 Million Americans

More than 42 million Americans hold student loans, with total outstanding debt exceeding $1.6 trillion. While wage garnishment targets only those in default, the scale of the broader crisis highlights how many households are still financially exposed.

Even borrowers who resumed payments after the pause are often just one setback away from delinquency.

What Borrowers Can Do to Stop Garnishment

Consumer advocates stress that wage garnishment is not inevitable; but action must be taken quickly. Borrowers in default should contact the government’s Default Resolution Group as soon as possible.

Options may include:

Loan rehabilitation, which allows borrowers to make a series of affordable payments to restore their loans to good standing

Loan consolidation, which can move loans out of default more quickly

Exploring eligibility for income-driven repayment plans

Once garnishment begins, stopping it becomes much harder.

A Shift Away From Lockdown-Era Leniency

In May, the Trump administration formally ended the pause on student loan collections. That move reopened the door to seizing tax refunds and other federal payments, paving the way for wage garnishment to follow.

Although payments technically resumed in October 2023, a one-year grace period delayed harsh penalties. That grace period has now expired.

Critics Call the Policy “Cruel and Unnecessary”

Advocates for borrowers have strongly criticized the decision. Several Democrats criticized the Trump administration and said the administration failed to do enough to help borrowers find affordable repayment options.

“At a time when families across the country are struggling with stagnant wages and an affordability crisis, this administration’s decision to garnish wages from defaulted student loan borrowers is cruel, unnecessary, and irresponsible,” advocates said.

Courts Blocked Forgiveness; Now Collections Accelerate

Attempts by the Biden administration to implement broad student loan forgiveness were repeatedly blocked by courts, leaving enforcement as the government’s primary remaining tool.

With forgiveness stalled and defaults rising, wage garnishment has emerged as the administration’s chosen response; one that will directly hit workers’ paychecks starting in January.

The Bottom Line for Borrowers

If you’re in default, the clock is ticking. The return of wage garnishment signals a tougher era for student loan enforcement, one that could quietly reduce paychecks for millions of Americans in 2026 and beyond.

For borrowers, the most important move right now is simple but urgent: don’t ignore the notices. Acting before garnishment begins could make the difference between regaining control of your loans; or watching your wages disappear.

Like Financial Freedom Countdown content? Be sure to follow us!

New Social Security CBO Proposal Would Cut Benefits for Top 50% of Retirees

The Congressional Budget Office (CBO) has released a controversial new budget option that aims to shore up the federal government’s finances by targeting the retirement checks of high-income Americans. With the federal deficit hitting a staggering $1.8 trillion in Fiscal Year 2025 and the Social Security insolvency clock ticking down to 2033, this proposal offers a stark look at one potential “fix”: changing the math to pay the wealthy less.

New Social Security CBO Proposal Would Cut Benefits for Top 50% of Retirees

Ray Dalio Joins Michael Dell in Backing Trump Accounts for America’s Kids

President Trump’s signature “One Big Beautiful Bill” created tax-advantaged “Trump Accounts” to give American children an investment-powered jumpstart in life. President Trump’s new child investment program is quickly attracting some of the most powerful names in American finance. Hedge fund legend Ray Dalio and tech billionaire Michael Dell are now publicly backing Trump Accounts, pouring billions of private dollars into a system designed to give U.S. children an early stake in the stock market. What began as a $1,000 government seed investment for newborns is rapidly evolving into a public-private wealth-building engine, backed by Wall Street, Silicon Valley, and major philanthropies. Supporters say the surge of elite funding is a clear signal that Trump Accounts could become one of the most significant long-term savings initiatives ever created for American families.

Ray Dalio Joins Michael Dell in Backing Trump Accounts for America’s Kids

Remember These Christmas Movie Houses? Their Prices Today Will Shock You

Christmas movies are timeless favorites. From Home Alone to Miracle on 34th Street, these beloved films feature now-iconic homes where families gather and holiday magic unfolds. We’ve all imagined living in these houses; but could the average American afford to buy one today?

Remember These Christmas Movie Houses? Their Prices Today Will Shock You

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.