The Congressional Budget Office delivered a major blow to the Trump administration’s fiscal arguments this week, quietly shaving $1 trillion off its projected savings from higher tariffs.

The downgrade instantly reignited concerns about America’s soaring borrowing needs and whether tariffs can truly shoulder the load Trump has claimed.

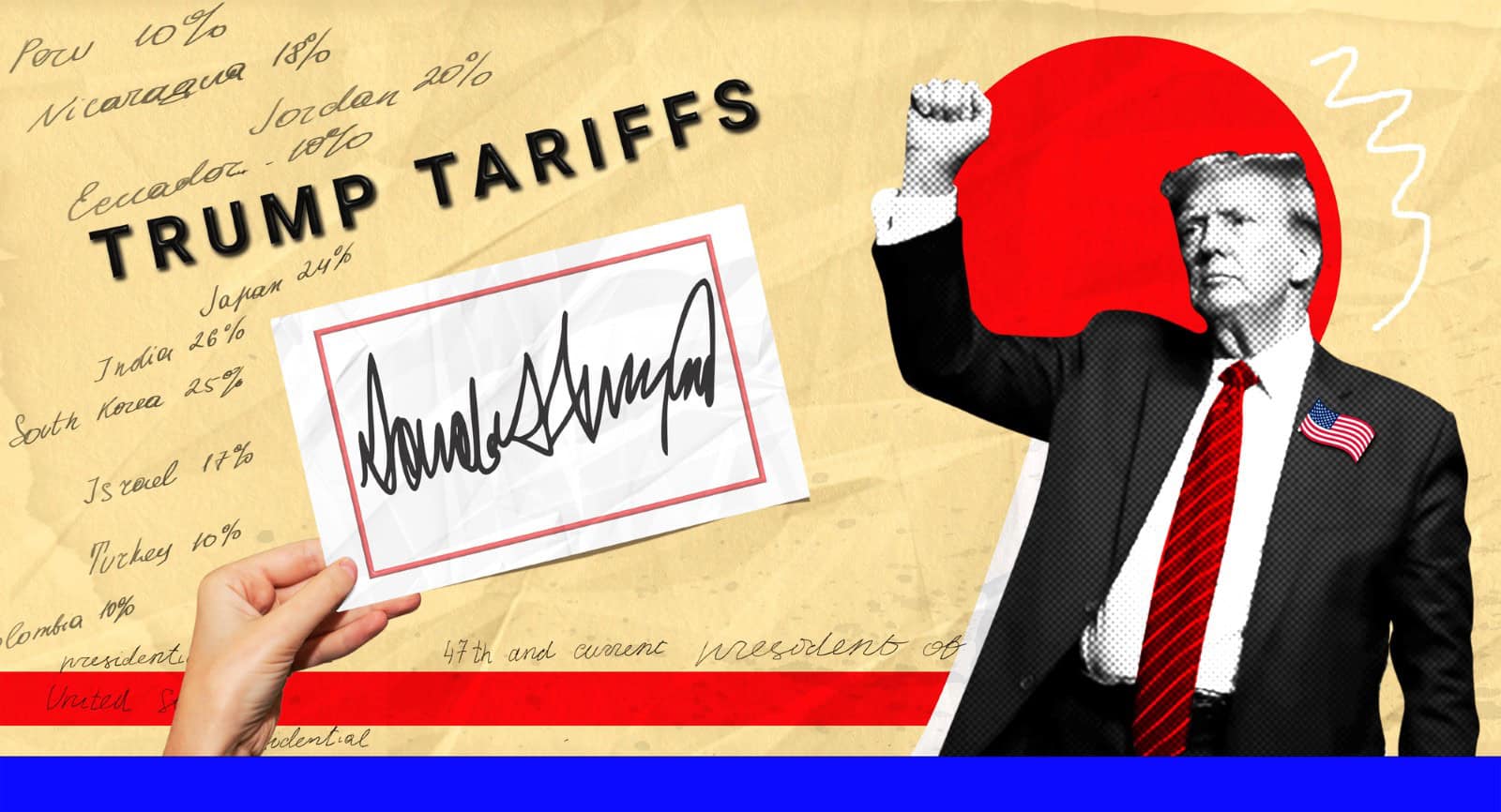

Tariff Windfall Shrinks to $2.5 Trillion

The CBO now projects that Trump’s tariff hikes will generate $2.5 trillion in deficit reduction from 2025 to 2035, well below the $3.5 trillion previously expected.

These revised numbers reflect both updated data and changing tariff structures in recent months.

Interest Savings Also Take a Hit

Lower deficit projections normally come with lower interest payments, but even these savings have wilted. The government is now expected to save $500 billion on interest costs; bringing the total tariff-linked deficit reduction to $3 trillion.

Just a few months ago, the estimate was $4 trillion.

Tariffs Still Don’t Cover Trump’s Tax Cuts

The downgrade highlights an uncomfortable fiscal truth: even with aggressive tariffs, Trump’s signature tax-cut law remains a net deficit booster.

The CBO estimated in July that the tax cuts will add $3.4 trillion to deficits through 2034.

Tariff savings now fall several hundred billion dollars short.

Why the Sudden Downward Revision?

CBO Director Philip Swagel pointed to two drivers: updated data and modifications to tariff rates. Roughly two-thirds of the revision stems from new data that forced the agency to recalibrate expected customs revenue.

Meanwhile, recent tariff adjustments also reduced savings estimates.

The Deficit Problem Is Still Getting Worse

Even with tariffs pushing more money into the Treasury, the U.S. fiscal picture continues to deteriorate. The government posted a $1.78 trillion deficit in the latest fiscal year; barely different from the $1.82 trillion recorded in 2024.

U.S. Debt Still On Track to Hit Records

Earlier this year, the CBO warned that federal debt would surpass post-World War II record levels by 2029.

And that was before incorporating Trump’s sweeping tariff and tax changes. The latest update makes the long-term debt picture even more uncertain.

Effective Tariff Rate Falls as Trade Deals Multiply

The administration has been striking trade deals that unwind portions of earlier tariff hikes.

As a result, the effective tariff rate now sits around 14 percentage points above last year’s baseline; down from an 18-point increase projected in August.

Tariff Adjustments Aim to Address Voter Anger Over Prices

Facing voter frustration over high prices; especially evident in recent off-cycle elections, the White House has been quietly adjusting tariff levels to reduce costs on key consumer goods.

Those tweaks, however, have also eaten into projected federal savings.

Where Would the Tariff Revenue Go?

The CBO assumes all tariff revenue goes straight to the Treasury.

But Trump has repeatedly floated the idea of issuing $2,000 “tariff dividend” checks to moderate-income households.

Congress has shown little enthusiasm for the idea, arguing that the funds should instead help rein in deficits.

A Supreme Court Wildcard Still Looms

The CBO’s estimates don’t account for a major legal risk: the Supreme Court could invalidate some of Trump’s tariffs. While economists believe the administration would attempt to recreate them using other tools, any disruption could further erode expected revenue.

What the Revision Means for Fiscal Politics

The revised numbers complicate the administration’s argument that tariffs alone can stabilize long-term borrowing. With a $1 trillion chunk of projected savings wiped away, fiscal hawks and skeptics alike are likely to press harder on how the White House plans to confront ballooning debt.

Like Financial Freedom Countdown content? Be sure to follow us!

Millions Could Miss Out on a New $1,000 Federal Retirement Match. Check If You Qualify

Beginning in 2027, millions of lower- and moderate-income savers will qualify for what financial researchers are bluntly calling “free money.” The new federal Saver’s Match; created under the 2022 SECURE 2.0 Act will replace today’s underused Saver’s Credit with a far more powerful benefit: up to $1,000 deposited directly into your retirement account every year. Morningstar’s early modeling suggests that eligible participants could see retirement wealth jump as much as 12%, a remarkable return for a program few Americans have even heard of.

Millions Could Miss Out on a New $1,000 Federal Retirement Match. Check If You Qualify

Maximize Your Benefits: Essential Social Security Strategies for Singles

While singles may have fewer Social Security filing options than married couples, smart planning around when to claim benefits can pay off for anyone, including those flying solo.

Maximize Your Benefits: Essential Social Security Strategies for Singles

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.