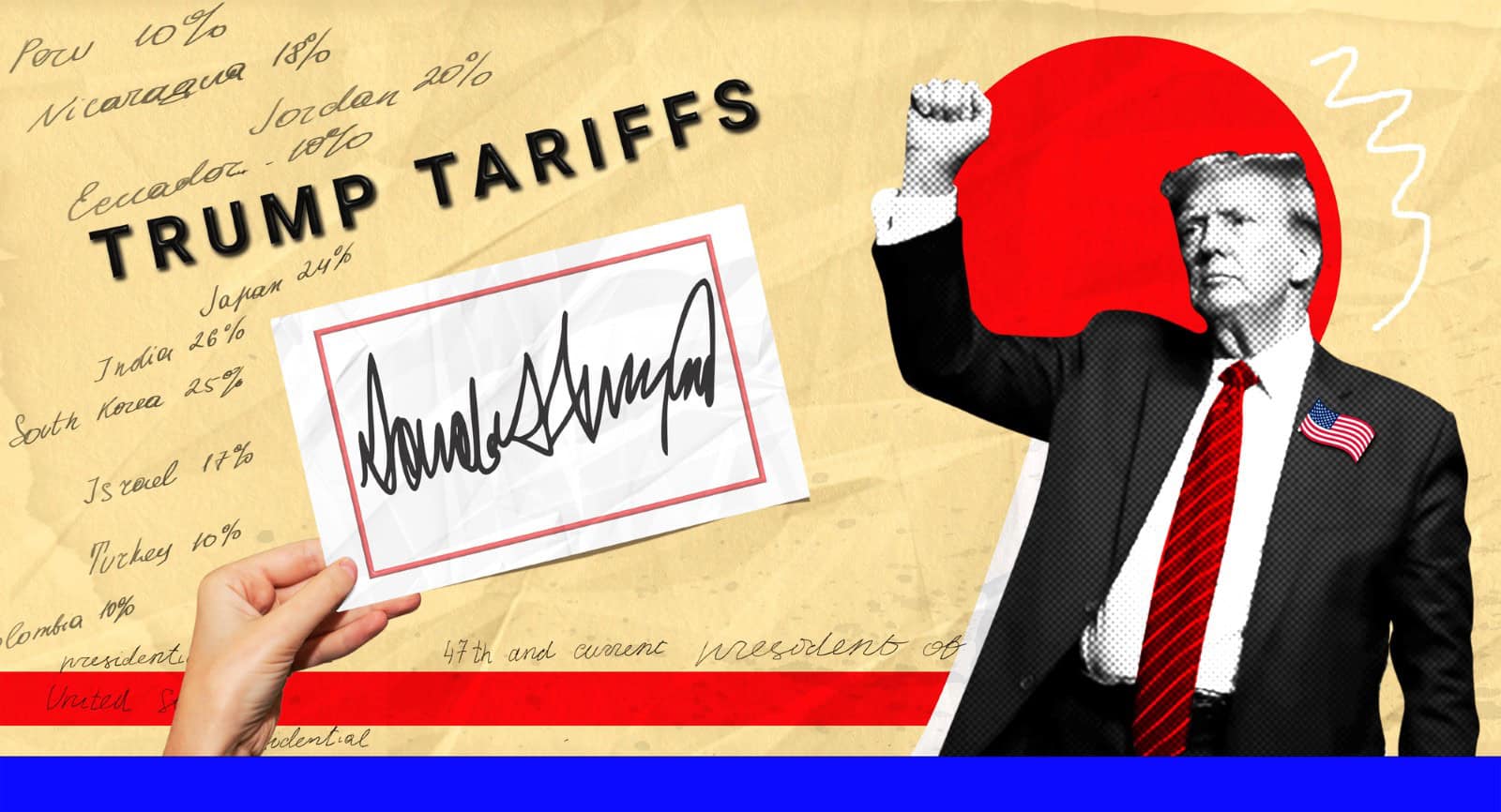

President Donald Trump offered his clearest timeline yet for the proposed $2,000 “tariff dividend,” telling reporters on Monday, Nov. 17 that payments would likely start “in the middle of next year, a little bit later than that.” He said the checks would be aimed at “individuals of moderate income” and funded by what he describes as surging tariff revenue.

Yet even as Trump tightens his pitch, his own Treasury secretary has introduced new hurdles; most notably that Congress would first need to sign off on the plan.

Trump Sets a Date: Mid-2026

Speaking in the Oval Office during an event celebrating the upcoming 2026 U.S. FIFA World Cup, Trump said the administration is preparing to deliver the dividends before the midterm elections.

“We’ve taken in hundreds of millions of dollars in tariff money. We’re going to be issuing dividends later on. Somewhere prior to, you know, probably in the middle of next year, a little bit later than that. Of thousands of dollars for individuals of moderate income, middle income”

He added that tariff revenue is robust enough to support both direct payments and debt reduction.

Trump Says No Checks in 2025

The timing marks a shift from earlier comments made aboard Air Force One last week, when Trump told reporters:

“No, no. Not for this year. It’ll be next year sometime.”

That set expectations firmly into 2026; and created the first specific timeframe for a proposal he has floated repeatedly since summer.

Where the Idea Came From

Trump has teased tariff-funded checks since July, when he first suggested tariff revenue could support “a little rebate.” He elevated the idea on Nov. 9, posting:

“A dividend of at least $2000 a person (not including high income people!) will be paid to everyone.”

Two days later, on Nov. 12, White House press secretary Karoline Leavitt appeared to endorse the plan.

Press Secretary: “We Are Committed to Making That Happen”

When asked how the White House planned to execute the proposal, Leavitt said:

“The White House is committed to making that happen, yes, and we are currently exploring all legal options.”

Her comment suggested the administration was already evaluating pathways to deliver the payments without jeopardizing other priorities like debt reduction.

Last week, in interviews, Treasury Secretary Scott Bessent described the dividend as something that could arrive in “lots of forms.”

He specifically pointed to tax breaks included in Trump’s signature tax-and-spending bill; the OBBB package; as examples of dividend-equivalent relief:

– No tax on tips

– No tax on overtime

– Senior bonus on some Social Security benefits

– Deductibility of auto loans

“It could be just the tax decreases that we are seeing on the president’s agenda,” Bessent said.

But This Sunday: Bessent Says Checks “Would Need Legislation”

On Sunday, Nov. 16, the Treasury secretary shifted tone.

Appearing on Fox News’ Sunday Morning Futures, Bessent confirmed that real checks would require formal congressional authorization.

“We will need legislation for that.”

“The checks could go out.”

“They would be for working families.”

This marks the clearest acknowledgment yet that Trump cannot issue rebate checks unilaterally.

Is There Enough Tariff Revenue to Pay for $2,000 Checks?

Probably not.

Tariff revenue collected since Trump’s second term began: ~$220 billion

Americans who filed tax returns in 2024: ~163 million

Cost of $2,000 per person: ~$326 billion

Shortfall: ~$100+ billion

Even if high earners are excluded and Trump’s plan excludes them; the math remains difficult.

A $100,000 income cutoff, for instance, would leave around 150 million eligible adults, costing about $300 billion.

Trump continues to argue that tariff revenue is so substantial that both checks and debt payoff are achievable.

On Nov. 11, he wrote:

“All money left over… will be used to SUBSTANTIALLY PAY DOWN NATIONAL DEBT.”

He cites current U.S. tariff collections as proof that “trillions” are flowing in — though Treasury data puts actual cumulative collections far lower.

Supreme Court Case Could Wipe Out a Major Portion of the Money

The administration’s tariff authority is currently under review by the Supreme Court, which appears skeptical of Trump’s use of the International Emergency Economic Powers Act.

Roughly $100 billion of tariff revenue came from emergency powers.

If the Court strikes them down:

The government may owe refunds to importers

The available “dividend pool” would shrink dramatically

The entire rebate concept could be legally or financially untenable

It could also create a refund nightmare if Congress authorizes checks and the Court later erases the revenue source.

Can Trump Simply Order the Checks Anyway?

No.

Even Bessent now acknowledges the constitutional constraint: Congress controls federal spending.

Past stimulus checks; in 2008, 2020, and 2021 all required legislative approval.

Would Congress Support It?

Politically, the idea is far from guaranteed:

Fiscal conservatives worry rebate checks could fuel inflation.

Democrats are skeptical of funding household payments using tariffs that raise consumer prices.

Moderate Republicans may balk at approving a large, deficit-increasing program before a midterm cycle.

Compromise in Congress would be a truly difficult task.

Inflation Risk: A Possible Red Flag

Economists warn that injecting $300+ billion into household budgets could revive inflation, leading the Federal Reserve to consider rate increases that would hit middle-class borrowers hardest.

This risk could erode Republican support inside Congress.

Other Attempted Stimulus Ideas Have Fizzled

Earlier this year, Trump considered sending Americans checks based on projected savings from DOGE, the Department of Government Efficiency.

The idea; pushed by Azoria Investment CEO James Fishback on X never advanced, and Congress showed no interest in adopting it.

So When Would Checks Actually Arrive?

Even if Congress approves the program:

Direct deposit payments: could arrive within a week

Paper checks: may take 20+ weeks, as seen during the last stimulus.

Trump’s own timeline of mid-2026 is therefore the earliest possible scenario.

A more realistic scenario puts any payments into late 2026 or early 2027; unless Congress blocks the effort entirely.

A Big Promise Meets a Complicated Reality

Trump has locked in a timeline.

But Treasury has now confirmed Congress must approve it.

And the Supreme Court could shrink the funding pool dramatically.

For now, Americans are left with a big promise, shifting explanations, and a growing list of political and legal hurdles that make the mid-2026 target far from certain.

Like Financial Freedom Countdown content? Be sure to follow us!

Millions Could Miss Out on a New $1,000 Federal Retirement Match. Check If You Qualify

Beginning in 2027, millions of lower- and moderate-income savers will qualify for what financial researchers are bluntly calling “free money.” The new federal Saver’s Match; created under the 2022 SECURE 2.0 Act will replace today’s underused Saver’s Credit with a far more powerful benefit: up to $1,000 deposited directly into your retirement account every year. Morningstar’s early modeling suggests that eligible participants could see retirement wealth jump as much as 12%, a remarkable return for a program few Americans have even heard of.

Millions Could Miss Out on a New $1,000 Federal Retirement Match. Check If You Qualify

After 50-Year Mortgage Backlash, Trump Floats New Fixes: Assumable Loans, Portable Rates, Even a Capital-Gains Break

The affordability crisis has grown too loud for any political figure to ignore, and Donald Trump has begun signaling that he understands the frustration. With home prices up, mortgage rates stuck near multi-decade highs, and inventory still thin, even middle-income Americans feel locked out. Trump has increasingly tried to position himself as the President willing to explore unconventional solutions to break the gridlock; solutions that stretch beyond traditional tax credits or zoning reform. His message: he’s aware, and he’s willing to test ideas, even if they’re controversial.

After 50-Year Mortgage Backlash, Trump Floats New Fixes: Assumable Loans, Portable Rates, Even a Capital-Gains Break

Treasury Hikes I Bond Rate to 4.03%, Yet Fixed Portion Drops — Here’s What It Means for Savers

The U.S. Treasury has announced a new 4.03% rate for Series I savings bonds, slightly higher than the previous 3.98%. But beneath the bump lies a subtle setback: the fixed-rate portion has slipped to 0.9% from 1.1%. That quiet change could reduce long-term returns for investors hoping to lock in inflation-protected income, even as I bonds remain one of the safest options for conservative savers.

Treasury Hikes I Bond Rate to 4.03%, Yet Fixed Portion Drops — Here’s What It Means for Savers

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.